The Canada Disability Bill 2025, also known as Bill C-22, is not just another government program. It is a major step toward helping millions of Canadians with disabilities who have been struggling with daily expenses and limited support. This bill introduces the Canada Disability Benefit (CDB), a new income support program offering up to $2,400 per year (about C$200/month).

It will be given to eligible Canadians aged 18 to 64 who qualify for the Disability Tax Credit (DTC). Applications for the benefit will start on June 20, 2025, and payments are expected to begin in July 2025. This program is meant to bridge the gap between provincial disability support and the actual cost of living, which has been a long-standing issue for many.

As one disability advocate said, “We’ve been told to wait for years, now the wait is finally over.”

Overview of the Canada Disability Benefit

| Program Name | Canada Disability Benefit |

| Legislation | Bill C-22 (Canada Disability Benefit Act) |

| Date Approved | June 22, 2023 |

| Regulations Effective | May 15, 2025 |

| First Payment Month | July 2025 |

| Highest Payment Amount | Up to C$2,400 per year (or C$200 monthly) |

| Eligibility | Canadians between 18 and 64 who have been approved for the Disability Tax Credit |

| Residential Status | Must be living in Canada (including citizens, permanent residents, and protected persons) |

| Retroactive Payments | May receive back pay for up to 2 years (starting only after June 2025) |

| Post Category | Finance |

| Official Website | Canada.ca |

What to Know About the Canada Disability Bill 2025?

The Canada Disability Bill 2025, also known as Bill C-22, is a new law aimed at helping people with disabilities have more financial stability and live with dignity. Its official name is “An Act to reduce poverty and to support the financial security of persons with disabilities by establishing the Canada Disability Benefit.”

This bill was passed in 2023, after years of pushing from disability rights groups. While the law itself laid the foundation, the actual rules that make the program work (called the regulations) only came into effect in May 2025, making it possible for the program to officially roll out.

The main goal of the Canada Disability Benefit (CDB) is to lower poverty and give financial support to Canadians with disabilities aged 18 to 64. It works alongside provincial support programs like ODSP in Ontario, AISH in Alberta, and SAID in Saskatchewan, acting like a top-up from the federal government.

Who Can Qualify for the Canada Disability Bill 2025 (CDB)?

To be eligible for the Canada Disability Benefit, you need to meet these 6 main conditions:

- Age: You must be between 18 and 64 years old (you’re still eligible the month you turn 65).

- Disability Tax Credit (DTC): You must have an approved DTC certificate.

- Residency: You must be a legal resident of Canada, as defined by the Income Tax Act.

- Tax Filing: Both you and your spouse/partner (if you have one) must file a yearly tax return.

- Incarceration: You cannot be serving a sentence of 2+ years in a federal prison.

- Not Suspended: If you were previously suspended due to fraud or non-compliance, your benefit will not resume until resolved.

How Much Payment Amount Can You Receive?

The Canada Disability Benefit (CDB) offers a maximum of C$2,400 per year, or C$200 monthly, and it’s non-taxable, so you keep the full amount. However, the actual amount varies based on your income and household size.

Lower-income individuals may get the full benefit, while those with higher earnings may receive less. For example, a single low-income person might get C$200, a couple about C$150 each, and someone earning C$25,000 may get around C$80–C$100 monthly.

Events and Dates

- Regulations Effective: The benefit regulations officially took effect on May 15, 2025.

- Application Opens: Applications can be submitted starting June 20, 2025, through Service Canada.

- Deadline for First Payment: To qualify for the first round of payments in July, applications must be submitted and approved by June 30, 2025.

- First Payments Issued: Initial payments will be released in July 2025.

- Monthly Payment Schedule: Ongoing payments will be made on the third Thursday of every month.

- Back Payments: Eligible applicants may receive up to 24 months of retroactive payments, beginning from June 2025.

How to Apply for Canada Disability Bill 2025?

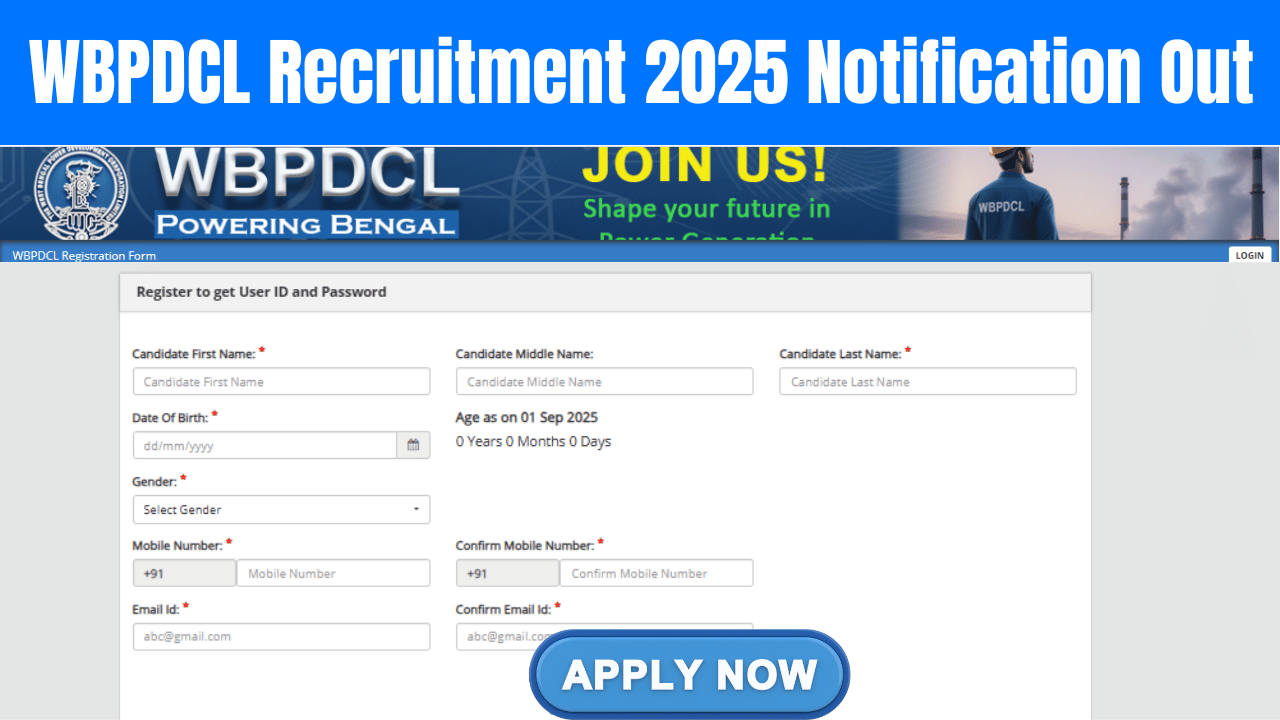

Here are the following steps to follow to apply for the Canada Disability Bill.

- Make sure your Disability Tax Credit (DTC) is approved by the CRA.

- File your 2024 tax return early to avoid any delays.

- Starting June 20, apply online through the Service Canada website.

- Include all needed documents like your DTC number, ID, and income details.

- Check your application status anytime in your Service Canada account.

- Once approved, you will get a notice and your payments will begin.

- Processing usually takes about 6 to 8 weeks. Keep your contact information and bank details updated so you do not miss anything.

Comparison of Canada Disability Benefit with Other Programs

| Program | Region | Average Monthly Payment | Taxable? |

| Canada Disability Benefit (CDB) | Federal (Canada) | C$ 200 | No |

| ODSP (Ontario Disability Support Program) | Provincial (Ontario) | C$ 1,308 | No |

| AISH (Assured Income for the Severely Handicapped) | Provincial (Alberta) | C$ 1,787 | No |

| U.S. SSI (Supplemental Security Income) | Federal (U.S.) | US $943 (~C$ 1,270) | Yes |

Frequently Asked Questions for the Canada Disability Bill

1. What is the Canada Disability Benefit (CDB)?

A federal program giving up to C$200 monthly to eligible disabled Canadians.

2. Who can apply for the CDB?

Canadians aged 18–64 with an approved Disability Tax Credit (DTC).

3. Is the CDB taxable?

No, the CDB payments are non-taxable.

4. How much can I receive from the CDB?

Up to C$2,400 per year, depending on your income.

5. When do applications open for the CDB?

Applications start on June 20, 2025, via Service Canada.